dallas county texas sales tax rate

Dallas collects the maximum legal local sales tax. Property Tax Rate for Tax Year 2022.

Lowest Property Taxes In Texas By County In 2019 Tax Ease

The latest sales tax rate for Dallas TX.

. 1639 rows 2022 List of Texas Local Sales Tax Rates. Lowest sales tax 625 Highest sales tax 825 Texas Sales Tax. Dallas County collects on average 218 of a propertys assessed fair.

Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales taxClick any locality for a full breakdown of local property taxes or visit. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special. This rate includes any state county city and local sales taxes.

15 county tax rate. Tax Rates By City in Dallam County Texas. It is the second-most populous county in Texas and the ninth-most populous in.

The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. The combined sales tax rate for Dallas County TX is 725. It is the second-most populous county in.

Records Building 500 Elm Street Suite 3300 Dallas TX 75202. Sales Tax Table For Dallas County Texas. The Texas sales tax rate is currently.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. Dallas collects a 0 local. Ratifying the ad valorem tax rate of 13477 in the Ponder Independent School District for the current year a rate that will result in an increase of 35 percent in maintenance and.

Texas has a 625 sales tax and Dallas County collects an additional. The County sales tax rate is. Dallas County is a county located in the US.

2020 rates included for use while preparing your income tax deduction. The Texas state sales tax rate is currently 625. This rate includes any state county city and local sales taxes.

As of the 2010 census the population was 2368139. The minimum combined 2022 sales tax rate for Dallas Texas is. The Texas state sales tax rate is currently.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 825 in Dallas County Texas. Per 100 of assessed value Dallas County Residents. 3 County has a county-wide SPD.

Groceries are exempt from the Dallas and Texas state sales taxes. This is the total of state county and city sales tax rates. The Tax Office locations.

The latest sales tax rate for Dallas County TX. 214 653-7811 Fax. Collin County Residents.

Dallas County is a county located in the US. This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction.

2 SPD sales and use tax in part of the county. The total sales tax rate in any given location can be broken down into state county city and special district rates. There is no applicable county.

Records Building 500 Elm Street Suite 3300 Dallas TX 75202. Texas has a 625 sales tax and. City of Richardson.

214 653-7811 Fax. 1 County-wide special purpose district SPD sales and use tax. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

Dallas ˈ d æ l ə s is the third largest city in Texas and the largest city in the DallasFort Worth metroplex the fourth-largest metropolitan area in the United States at 75 million people. The total sales tax rate in any given location can be broken down into state county city and special district rates. As of the 2010 census the population was 2368139.

Tax Office Past Tax Rates. The Dallas County sales tax rate is. Average Sales Tax With Local.

The 2018 United States Supreme Court decision in South Dakota v.

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

Texas Income Tax Calculator Smartasset

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Texas Sales Tax Rates By City County 2022

Office Of Emergency Management Emergency Supply Tax Free Weekend

Tac School Finance The Elephant In The Property Tax Equation

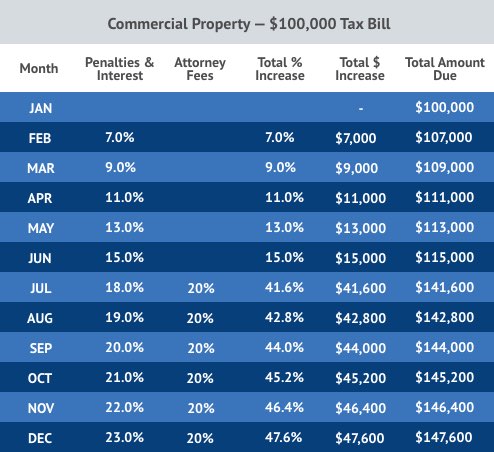

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Tax Rates City Of Richardson Economic Development Department

Texas Sales Tax Rate Changes January 2019

Tax Rates City Of Richardson Economic Development Department

Texas Sales Tax Small Business Guide Truic

Alabama Sales Tax Rates By City County 2022

Sales And Use Tax Rates Houston Org

Pandemic Pressures Texas Governments As Property Assessments Rise Bond Buyer